Get Pre-Approved, not Pre-Qualified!

The real estate market is HOT right now in Phoenix and surrounding areas. With home inventory levels being significantly low coupled with the interest rates being low, newly listed homes are being sold within a few days or even hours of being listed! These newly listed homes are often receiving multiple purchase offers, which is excellent news for sellers.

Having multiple offers, on the other hand, is not excellent news for buyers. It is paramount for a buyer that is getting involved in a multiple offer situation, that they have a great mortgage loan specialist representing them that has experience with multiple offer situations.

Losing out on a house can be heartbreaking and frustrating for a buyer, so make sure when hiring the “right” loan specialist to work with, find out what they do to help their clients win in multiple offer situations!

First things first, there is a major difference between pre-approval and pre-qualification!

Understanding the difference is extremely important.

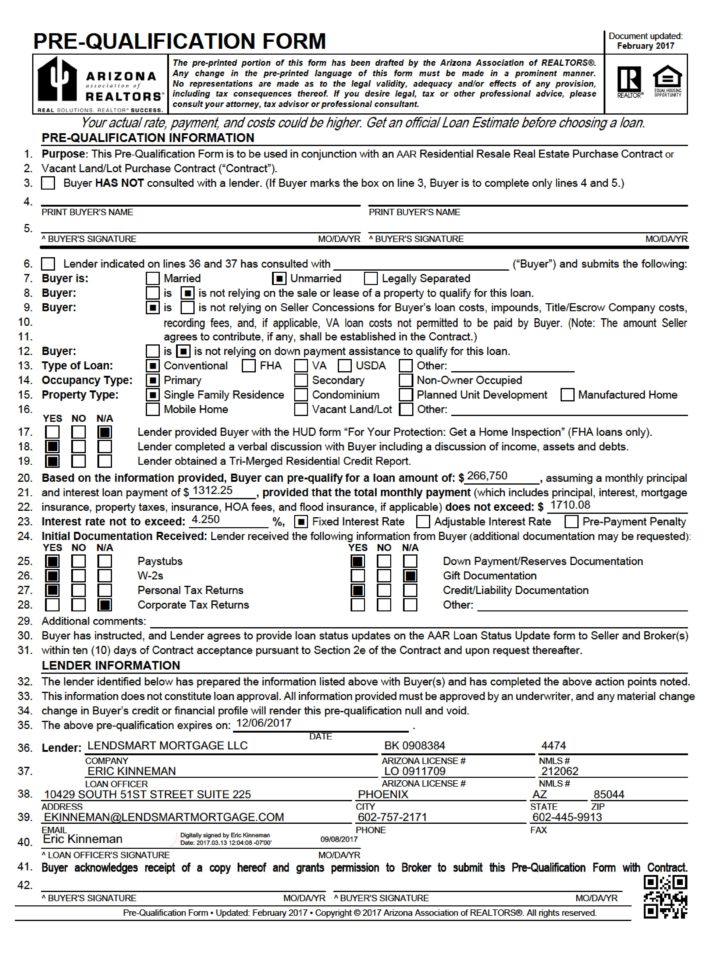

A pre-qualification is when a lender looks at a buyers overall financial picture based on what the buyer tells them. In most cases they will also look at the buyers credit information to make sure their credit scores are in line with the current mortgage guidelines. The lender will then issue a “Pre-Qualification” letter, subject to verification of information that you provide once you apply for your mortgage. Unfortunately, on occasion a pre-qualification letter is issued to a potential buyer without verifying the information provided by that buyer. It is possible that down the road they are declined once the information they provided is verified.

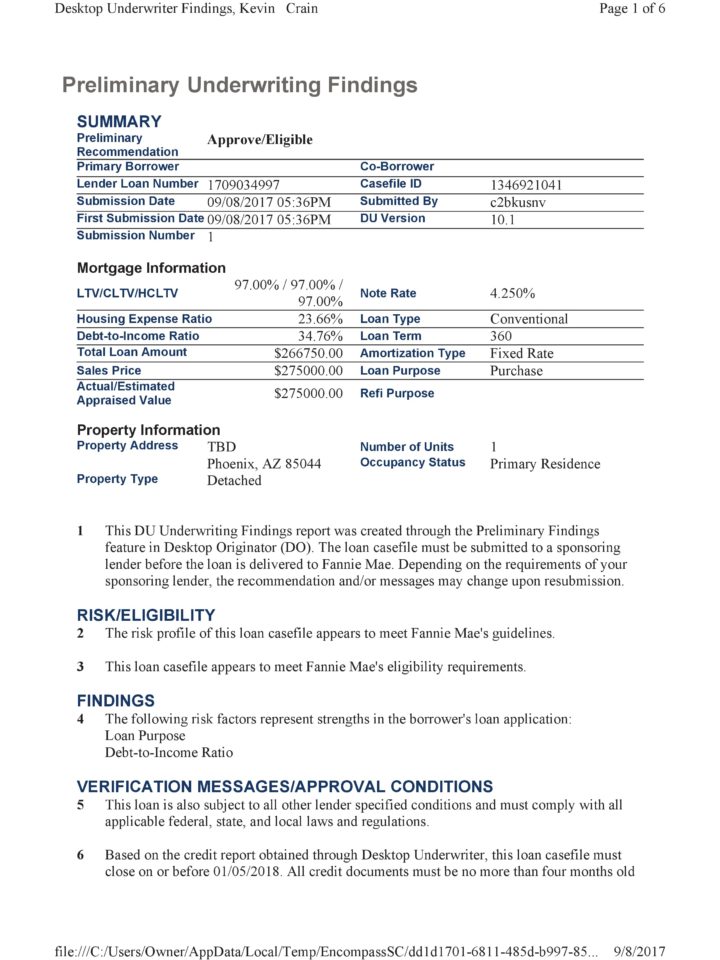

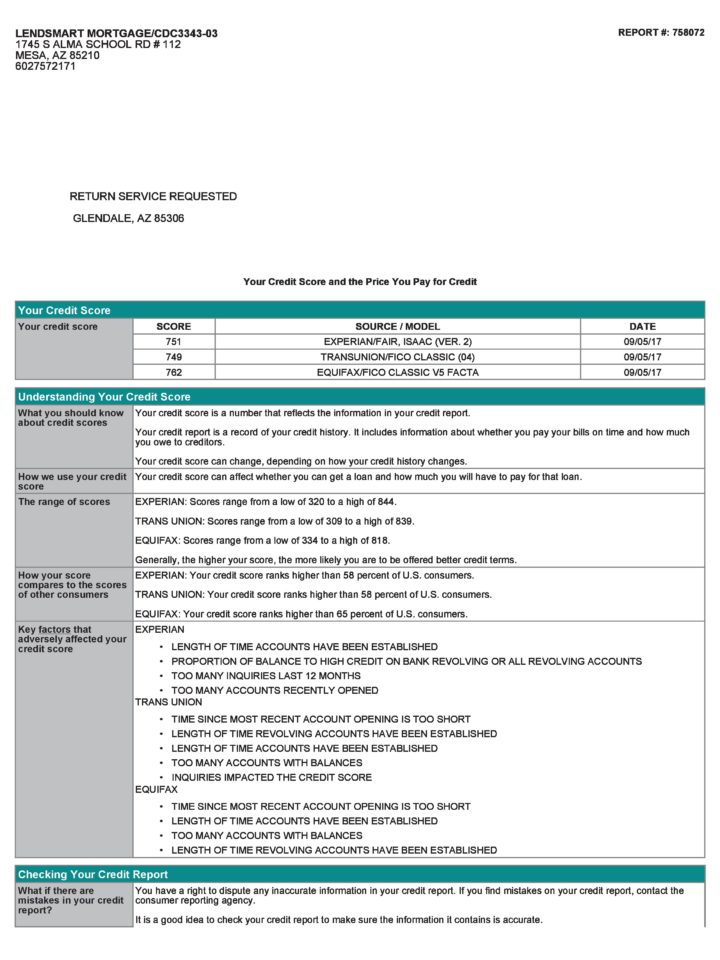

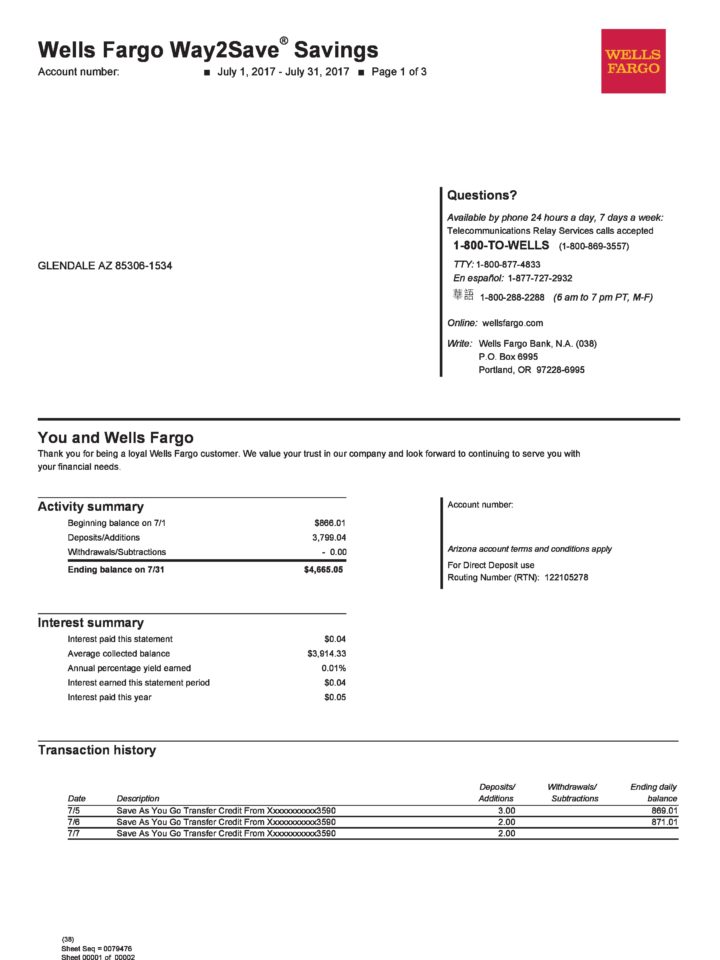

A pre-approval is typically a little more involved but is much more desirable when it comes time to negotiate on a home. Getting a pre-approval includes a lender pulling a fact data (tri-merge) credit report, collecting pay stubs, bank statements, W-2’s, etc. and actually confirming employment statuses (referred to as a VOE or “Verification of Employment”). Most pre-approvals are as good as a mortgage commitment, and are generally only subject to a bank appraisal being done on the subject property.

In a multiple offer situation, being pre-approved is extremely important and often times it makes a huge impact on which offer a seller may choose to work with.